How Malaysia E-Invoice System Works & Implementation Dates 2025 - 2026

Malaysia's move toward mandatory e-invoice system is set to be fully implemented by 2026. For restaurants, preparing for this change early is key to ensuring a seamless transition.

Contents

- Understanding the Scope of E-Invoicing

- Why E-Invoicing Matters for Restaurants

- How the E-Invoice System Works

- Malaysia E-Invoice Workflow

- Malaysia E-Invoice Implementation Timeline 2025 - 2026

- Starting from August 1, 2024

- Starting January 1, 2025

- Starting July 1, 2025

- Starting January 1, 2026

- How Eats365 Help With Restaurant E-Invoicing Processes

Malaysia's move toward mandatory electronic invoicing (e-invoicing) signals a major shift in the way businesses handle transactions and taxation. The Inland Revenue Board of Malaysia (IRBM) spearheads the initiative, which is set to be fully implemented by January 2026.

Restaurants and other small businesses must now align their processes with this digital transformation, which promises greater efficiency and enhanced compliance. For restaurants, preparing for this change early is key to ensuring a seamless transition.

Understanding the Scope of E-Invoicing

Some might wonder, "What is e-invoice"? E-invoicing is a digital framework requiring businesses to generate, validate, and transmit invoices electronically through approved systems. This system is a core component of Malaysia's digital economy strategy, aimed at modernizing tax administration and reducing fraud.

What is the use of e-invoice? For restaurants, this represents both an opportunity to streamline operations and a challenge to adapt to new regulations.

Why E-Invoicing Matters for Restaurants

E-invoicing is more than just a compliance requirement - it's a tool for efficiency.

By digitalizing the invoicing process, restaurants can reduce manual errors, accelerate payment cycles, and improve record-keeping. Additionally, validated invoices ensure transparency and accuracy, helping restaurants maintain better relationships with suppliers and customers.

Read more: 6 Important Restaurant POS Features That Are Often Overlooked (eats365pos.com)

How the E-Invoice System Works

The Malaysian e-invoicing system operates on strict standards to ensure security and compatibility. Invoices must be created in formats like XML or JSON, which enable automated processing.

Each invoice must then be validated through the government's MyInvois platform or other authorized providers (API) before being sent to recipients. Digital certificates are required to authenticate these transactions, ensuring data integrity and confidentiality. Restaurants must familiarize themselves with these requirements to avoid disruptions in their billing processes.

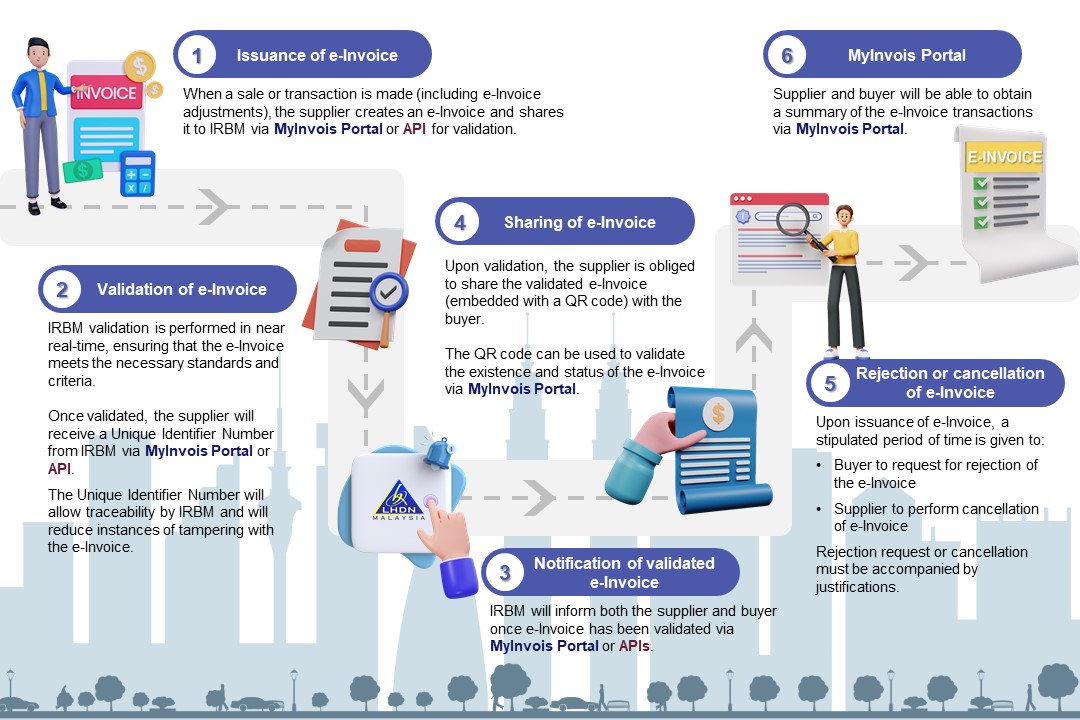

Malaysia E-Invoice Workflow

-

Insurance of e-Invoice

When a transaction is made, the supplier creates and e-invoice and shares it to IRBM via MyInvois Portal or API for validation. -

Validation of e-Invoice

IRBM performs real-time validation and sends a traceable Unique Identifier Number via MyInvois Portal or API once the e-Invoice's validated. -

Notification & sharing of validated e-Invoice

IRBM informs both supplier and consumer about the e-invoice's been validated.

The supplier at the same time should share the validated e-invoice with its QR code to the consumer.

Reference: Overview of the e-Invoice Model | Lembaga Hasil Dalam Negeri Malaysia

Malaysia E-Invoice Implementation Timeline 2025 - 2026

The e-invoice implementation in Malaysia is in 3 phases, based on the annual turnover or revenue thresholds, the taxpayers should adapt to e-invoice implementation:

Starting from August 1, 2024

Taxpayers with an annual turnover or revenue of more than RM100 million

Starting January 1, 2025

Taxpayers with an annual turnover or revenue of more than RM25 million and up to RM100 million

Starting July 1, 2025

Taxpayers with an annual turnover or revenue of more than RM500,000 and up to RM25 million

Starting January 1, 2026

All taxpayers (annual turnover or revenue of more than RM 150,000 up to RM500,000)

How Eats365 Help With Restaurant E-Invoicing Processes

Eats365 offers businesses a scalable F&B POS system, allowing restaurant operators to select the functions they need based on their operational requirements. Whether growing from a single store to multiple stores or even expanding internationally, Eats365 POS can support the continuous growth of restaurants of all sizes.

Eats365 provides all-in-one platform with dedicated e-invoice reports, helping restaurants with fast & easy submissions and requests of e-invoice. With the hassle-free automated month-end e-invoice submissions, Eats365 helps restaurant owners eliminating tedious manual invoicing works and errors and keeps your business stay compliant with latest government regulations.

Consult our F&B experts for more information or request free demo now!